The only thing that should be recharged in advance was an effective credit score assessment, and therefore costs about $20, and you should be prepared to purchase one $20 a few times over while you are searching loan providers. When you’re concerned with twenty dollars if you’re trying to get a home loan, chances are that cannot implement.

We, as that loan manager, do not require your modern data files to have things I can imagine out of

After you have picked a supplier, however, anticipate paying towards the assessment prior to it being complete. The appraisal code off carry out implies that they’re going to find purchased people appraisal done. Creditors has no power over the newest assessment processes, and when ordered, no method from attention when your value is actually lowest, whenever you are being compelled to pay one to appraiser. It indicates all loan company available has received to make a great bleak selection: Determine whether to fees an initial put, or jack upwards their margins so that the somebody whoever fund close and you will funds purchase the latest appraisals of those that don’t. As i told you within the Creditors Providing to pay for The newest Appraisal, consequently those companies that give to cover the brand new appraisal (i.e. love to jack up the prices) makes more. Your decision about and therefore to handle, but in any event you decide on, you will need to carry out initial homework. My personal alternatives has been to need fee on appraisal in advance of I purchase it. I do not such as doing this however, I really like the exact opposite off asking those members who adhere enough to buy the clients that simply don’t significantly less.

Dumps was in fact typically billed because of the lenders who would like to enable you to get dedicated to the mortgage, and additionally they exercise for at least a few factors. The foremost is emotional relationship. Constantly while i explore things such as one to, I get individuals who immediately come back with, « Those kind of mind online game aren’t effective beside me! » I am not looking a disagreement, sufficient reason for most anyone, I’m not sure the past history well enough in the future right up having an illustration, however, it event is largely universal as far as human beings wade, and the ones couple maybe not at the mercy of they are probably experiencing different far more debilitating psychological state. In fact, the standard progression of a loan is several duties abreast of your region. The decision to correspond with prospective team. The program.

But never provide the bank any more compared to the assessment money

Following the application, lenders wanted this new originals of documentation and cash. The first data is questioned and that means you don’t shop or apply for financing elsewhere. I want the original of the loan application and you can a couple other things you fill in with me, not of your pay stubs, their taxes, their insurance rates bill, or any other data you have pre-present. Duplicates are only okay for any lender I really do team that have, as long as he’s neat and viewable.

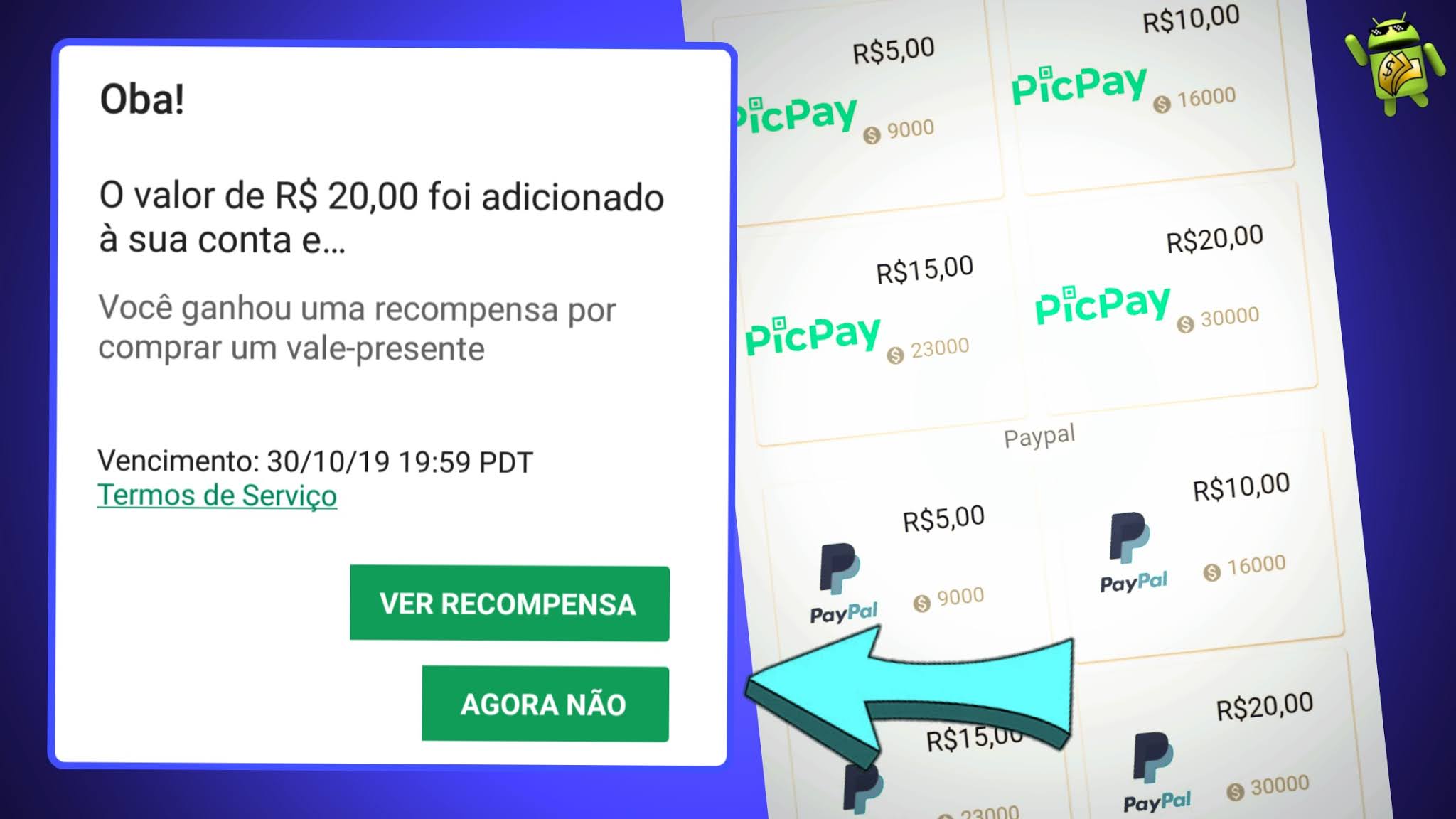

The next step is locate money of your. If the needed ‘s the credit report commission of about $20, that’s okay and you may normal. Credit file cost money, and if you are just shopping around, a lender features two choice: raise its loan cost slightly so that they costs people just who finalize its financing far more, otherwise charge men and women whatever the cost is to try to work with credit whenever it pertain.

But some financial institutions require over the credit view percentage. A lot more. They need a deposit that varies from several hundred or so cash in order to one percent of the loan amount, even several percent occasionally. They could say it is to the assessment, and generally at the very least element of it does check out the appraiser. We www.paydayloancolorado.net/fort-morgan/ accustomed claim that don’t give it to help you them, although conditions behind you to pointers are changing. I have had my personal members let me know towards reports they’re informed, about that money should be to spend the money for appraiser. A very important thing for people is the fact that the appraisal is purchased in the event the appraiser really does the work. Unfortuitously, the latest assessment laws prohibit an individual paying the appraiser myself, and need the lender to expend the latest appraiser (and additionally avoiding the bank out of capturing crappy appraisers). As I’ve said before, we would like to function as the individual who instructions the brand new appraisal, and that controls it. Unfortunately, the fresh requirements completely exclude which user advantage. An appraisal over within the old technique for team will cause it to not simply be squandered currency since it is unsuitable, they stands a good chance away from costing a lender their ability to accomplish any organization. Therefore you could have zero genuine alternatives however, to put an excellent put towards the assessment up-front side.