Yarilet Perez was a talented multimedia journalist and fact-examiner that have a king out-of Research when you look at the Journalism. She’s got worked from inside the numerous metropolitan areas covering cracking development, government, training, and more. Their systems is actually private money and purchasing, and a home.

What’s the Perfect Interest rate?

The top interest ‘s the payment that U.Smercial banking institutions fees their extremely creditworthy customers for money. As with any loan cost, the top rate of interest is derived from the newest government funds’ right away price, put from the Government Reserve at the meetings held eight moments a 12 months. The top interest is the benchmark banks or any other lenders play with whenever setting their attention rates for every sounding financing away from credit cards so you can car and truck loans and mortgage loans.

At the time of , the prime rate of interest is actually 8.5%. The brand new government financing speed is actually set within 4.75% so you can 5% in . The brand new Government Open-market Panel (FOMC) slice the rate from the half a percentage point regarding 5.25% to help you 5.50%-a speeds which was held for over per year.

Secret Takeaways

- The top price ‘s the interest rate one industrial finance companies fees the very creditworthy corporate people.

- The top speed is derived from the newest government money speed, always playing with provided financing + step three because the algorithm.

- The latest cost for almost all most other fund along with mortgages, small business finance, and personal financing depend on the prime rate but can vary on account of other factors such as mortgage request.

- Just like the extremely creditworthy clients get the prime rate, all others rating mortgage according to the credit history in addition to a percentage on top of the perfect price.

- The absolute most are not quoted primary speed is certainly one penned every day from the TheWall Highway Journal.

The Best Rate Work

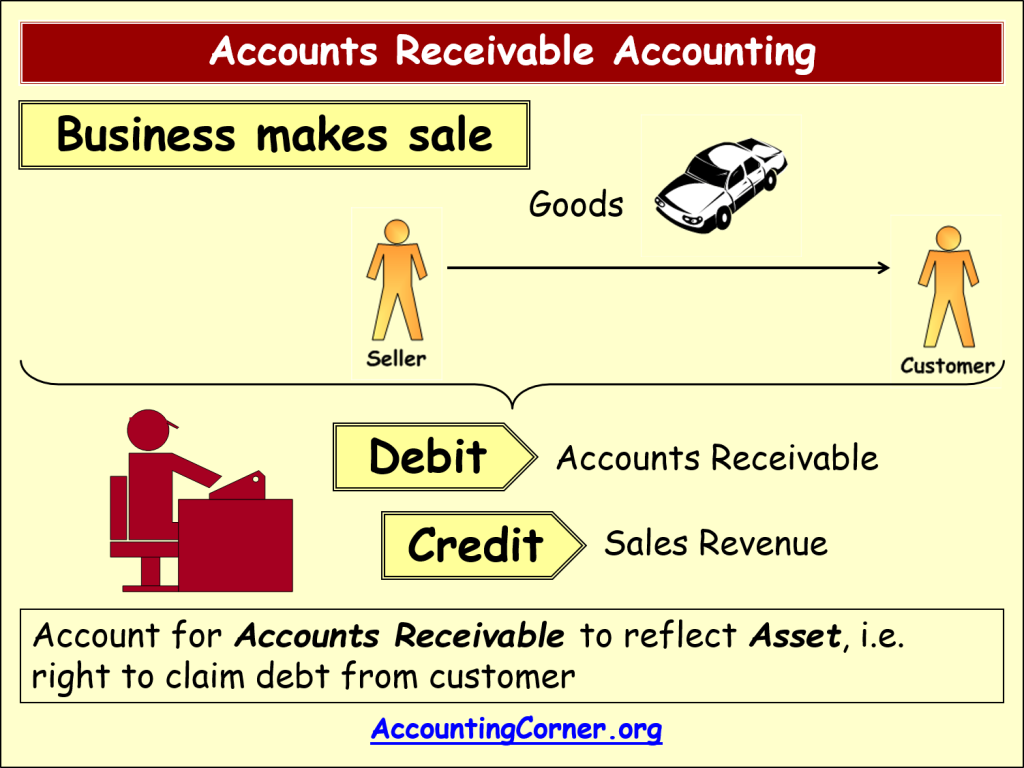

Mortgage loan ‘s the percentage of a loan amount you to definitely a loan provider fees. It is the lender’s compensation, additionally the fee may differ with every variety of mortgage. Basically, any personal loan instance a americash loans Mountain Meadows credit card balance try billed interest on a higher level than just a guaranteed mortgage such a car loan or a mortgage.

The pace that a single or business receives vary mainly based towards the borrower’s credit history and other economic information.

The brand new Government Loans Price

The top interest rate, which is also known as perfect credit price, is simply dependent on the fresh new government financing price set of the FOMC of one’s Federal Set aside.

This new given money rates ‘s the right-away rates banks or any other creditors used to give money together. The procedure is a constant electronic disperse of cash you to definitely guarantees that each and every lender keeps enough exchangeability to run of date so you can big date.

The prime Rate

Banks generally have fun with an algorithm from federal finance rates + step 3 to determine the best rate they charge the most useful customers, primarily higher businesses you to obtain and pay off loans for the an even more otherwise shorter constant basis.

That primary rates is the starting point for all other attract costs, which are set within finest rates including a supplementary percentage.

The bank sets various interest rates per mortgage sorts of. The new costs personal consumers is charged depend on its credit score, money, and most recent bills.

Including, anyone with a great credit history would be charged, say, prime and additionally 9% for a credit card, while you are just one with only an excellent rating might get a great speed away from perfect plus fifteen%.

Determining the prime Price

The top rates is determined by individual finance companies and you can made use of because the beds base rate for the majority style of money, along with loans to help you small enterprises and you can playing cards. This new Government Reserve has no direct role in setting the top rate, but the majority financial institutions choose set their best rates established partially towards target quantity of the latest government finance price established by FOMC.