While over sixty years old, individual your property, and want loans having senior years, unlocking the fresh new equity of your house are an economic provider. Before you are doing, you should weighing a number of key considerations.

In this post

- What’s house security discharge?

- Kind of domestic equity launch financing

- Affects out of family guarantee launch money on the Years Pension

- How does it affect upcoming aged care will set you back?

- Is an alternative: Household Security Access Design

- Opposite mortgage compared to HEAS: What type if you do?

- Would you nevertheless leave an inheritance?

Family guarantee ‘s the current market worth of your home, without any the mortgage otherwise financing stability you have got against they. As you pay their home loan, your guarantee increases. After you’re totally paid down, you have complete guarantee.

What’s household equity launch?

Household equity launch was a method in which allows people so you can tap the newest riches tied within their possessions instead selling it. It is mainly targeted at Australians old sixty or old exactly who will dsicover themselves house-rich however, cash-terrible, as it is made to provide a solution to complement their money, finance a warmer old age, or shelter medical or other bills while they are still-living about assets.

The amount of equity and this can be released depends on numerous facts such as the value of your house, this new homeowner’s decades, as well as the specific formula of your equity release seller otherwise design.

The age requirements means that the fresh new applicants off house equity release systems have in all probability situated generous guarantee within home. Basically, the brand new old you are, the greater amount of money you can possibly discharge.

But not, its imperative to remember that establishing the newest guarantee in your home involves a number of dangers which can impression your own estate and work for entitlements.

Brand of house guarantee launch fund

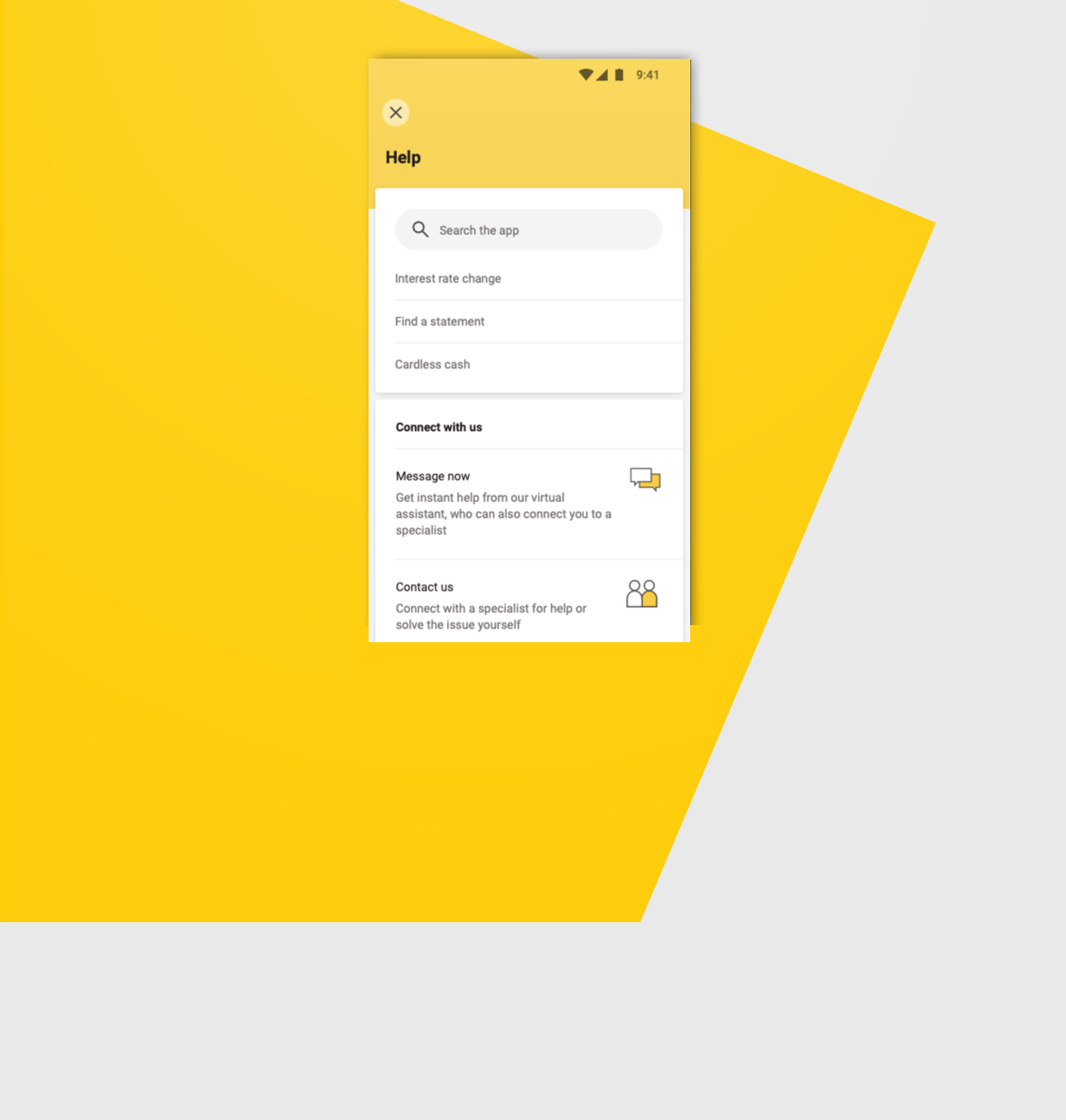

![]()

Certain guarantee launch preparations (but HEAS, more on one to later on) are thought credit agreements and thus regulated by Australian Ties and you may Assets Percentage (ASIC). Organization need hold a keen Australian Borrowing Permit (ACL) to provide these materials.

« Its important to understand the different types of house equity launch activities available. You may have your own contrary mortgages and you will home reversion systems, for each using its advantages and disadvantages, » C.L. Mike Schmidt, an attorney in the Schmidt & Clark LLP, informed InfoChoice.

Opposite Home loan

A face-to-face mortgage is a type of loan which allows property owners old sixty as well as so you can borrow funds utilizing the collateral into the their residence as cover. Opposite mortgages are offered because of the individual lenders and you can typically have highest interest rates and you may charges.

Contained in this plan, minimal you could potentially draw is generally $10,000 additionally the most is probable fifteen-20% of your worth of your house. Depending on your own financial rules, you can use the number you borrow while the a normal income stream, a lump sum payment, or a mixture of one another.

Your given that resident keep possession of your property and you can, rather than for the regular mortgage loans, need not generate repayments if you’re way of living indeed there. Although not, the eye charged compounds throughout the years which can be added to this new prominent loan amount – this will rapidly enhance the financing well worth and erode your leftover collateral.

Therefore, that isn’t uncommon that security commonly drop off take a look at the site here as your personal debt increases over the loan’s lifetime. When this occurs, « the latest beneficiaries of the borrower get inherit smaller, given that a significant portion of the home can help pay the mortgage, » Mr Schmidt said.

The primary therefore the accumulated attention is actually paid back whenever happens go out the fresh new debtor or even the house sells the home, otherwise when the homeowner moves aside or becomes deceased.