Time Restriction to own Prepayment Punishment-36 months

A good prepayment penalty is only invited for the very first 36 months adopting the loan is actually consummated. Shortly after three years, an effective prepayment punishment isn’t anticipate. (twelve C.F.R. (g) (2024).)

Financing is actually « consummated » if the borrower will get contractually required on mortgage. Depending on county laws, this might be when the mortgage documents was closed otherwise whenever the lender commits to give borrowing from the bank into borrower, including.

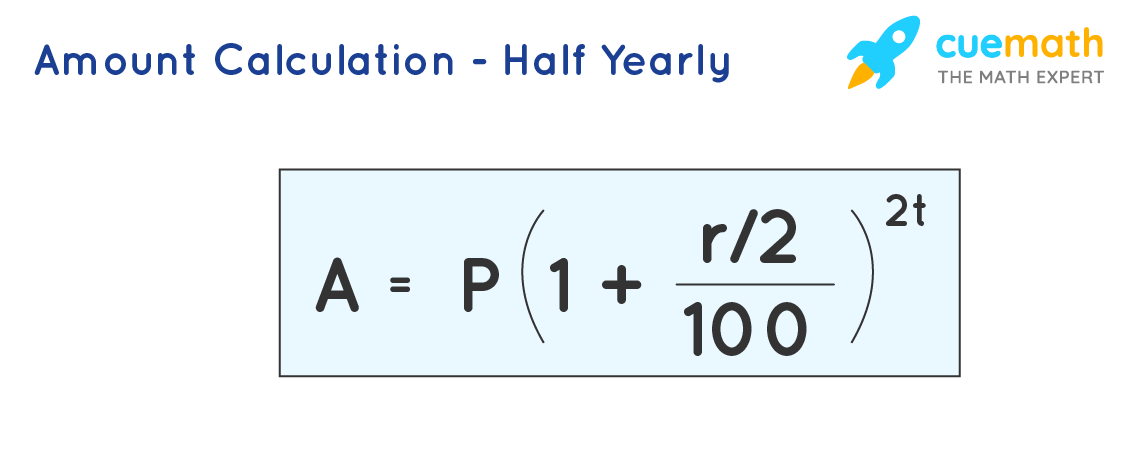

Just how Loan providers Calculate Prepayment Penalties

To the first two many years adopting the mortgage is consummated, the new punishment can not be greater than 2% of one’s amount of the newest a great loan harmony. On 3rd seasons, brand new penalty is actually capped in the step one% of one’s a good financing balance.

Bank Might also want to Provide that loan Alternative Rather than good Prepayment Punishment

At exactly the same time, if the a lender also provides a loan that includes an effective prepayment penalty, the financial institution should provide a choice loan that does not become good prepayment penalty. In this way, the lending company should have a good faith religion your consumer probably qualifies toward choice financing.

Bank Must provide Your With information Regarding the Prepayment Punishment

Beneath the CFPB rules, if financing possess good prepayment punishment, the brand new servicer otherwise lender need certainly to tend to be factual statements about the new punishment:

- on the periodic asking declaration (which is usually sent monthly) (several C.F.R. (2024)) or

- in the discount book (that is a book provided with the new servicer otherwise financial that have a typical page for every single asking course to possess a-flat period, usually 12 months, where there debtor tears from a typical page otherwise part of the webpage and returns they toward loan servicer with each fee), and you may

- in the rate of interest variations sees.

Prepayment Penalty Statutes Usually do not Connect with Pre-2014 Mortgage loans

The mortgage servicing rules away from prepayment charges ran into effect on , plus don’t use retroactively. Very, lenders didn’t have to help you follow this type of legislation having mortgage loans produced prior to .

Tips Know if Your loan Possess an effective Prepayment Punishment

When you need to see if the loan features a great prepayment punishment, look at your monthly billing statement or coupon publication. You may want to look at the records you finalized from the loan closure. Always, sentences regarding prepayment penalties can be found in the new promissory notice or often within the an addendum towards the notice.

Exactly what are the Advantages and disadvantages out of Mortgage Prepayment Punishment?

Home loan prepayment punishment have upsides and drawbacks. To the positive side, financing with a good prepayment penalty have a lesser focus rates. Thus, the monthly payment will be straight down, while could save profit the long term. (Towards the lender, the positive element of having a prepayment penalty is the fact it discourages a debtor regarding refinancing.)

The new disadvantage having an effective prepayment punishment to your borrower is it can be costly to promote or refinance your home prior to the fresh new punishment period stops.

How to prevent Financial Prepayment Punishment

To prevent financial prepayment punishment, believe in search of home financing and no otherwise a low prepayment punishment. This course of action might cover settling having lenders otherwise trying to find a different sort of home loan unit. Today, prepayment punishment are much less frequent than in the past, and you payday loan Arley will certainly be able to get financing without it.

For individuals who have home financing, you should understand its terms and you will very carefully plan the repayment method. Very carefully feedback your loan data files to determine any conditions connected with prepayment penalties. When your mortgage loan provides a beneficial prepayment penalty, you can test to make a lot more repayments inside one acceptance limits specified on the price. But never pay the mortgage until after the penalty period concludes.

Be sure to keep in touch with their bank to explore repayment choices and ensure you may be totally familiar with any possible expenses associated with settling their financial early.

To learn more

For additional info on brand new CFPB statutes in the prepayment charges (therefore the most other financial servicing legislation that went towards the impact on ), visit the Consumer Monetary Defense Bureau’s web site.