If you are searching to order property and also have a limited down payment or good not so prime credit history, Ca FHA Mortgage may be the most suitable choice. If you’re a first time home visitors, a duplicate visitors, otherwise seeking to re-finance, you might want to check out FHA money inside the Ca.

California FHA Loan Credit score Criteria

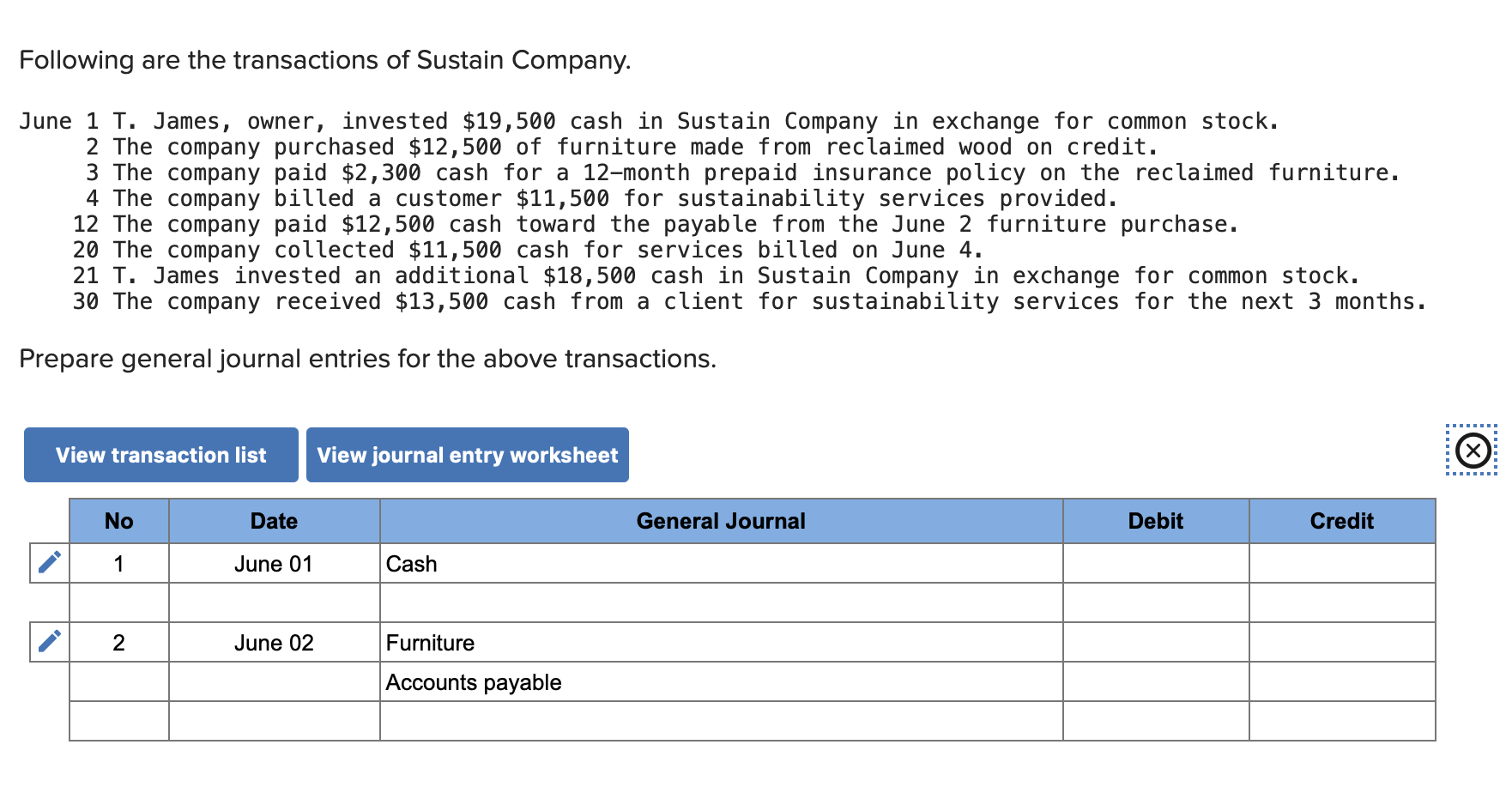

So you’re able to be eligible for an FHA financing, you’ll need a credit rating of at least 580. This is why, this can allow you to to enjoy the 3.5% down payment work for. Even when this is the situation, a diminished credit score will not disqualify your instantly. The prerequisites connected with the credit get are different with the financial. This is an excellent reasoning to buy as much as before you could settle with the most useful financial. Evaluate just what different loan providers are offering while you contrast them into the standard market also offers.

Restrictions

This new limitations of sum of money you should buy compliment of a california FHA Financing usually disagree. This is exactly based where the residence is located. The quantity is actually computed due to the fact 115% of the county average domestic rate. You will find different units online you can make use of to get the limitations based on your neighborhood. To get into the brand new condition limitations, click on this link.

Mortgage Insurance rates

If you need a keen FHA mortgage, it will take financial insurance policies. This means that you will shell out a-one-date beforehand financial advanced that is comparable to step one.75% of loan amount to close off. The loan will also require that you shell out a monthly home loan insurance of 0.85% of your own loan amount a-year.

You might spend the money for financial cost upfront during the closure that have the latest Ca FHA mortgage. It is possible to like to have it included in the borrowed number. The loan number, loan-to-worthy of ratio as well as the mortgage identity determine the fresh new superior you have to pay annually.

Other Crucial Standards

Plus the requisite step 3.5% of purchase price given that down payment, there are even most other conditions of the Ca FHA mortgage.

- New debtor you would like a valid Social coverage count

- The fresh debtor must provide facts that they are Us citizens, legal long lasting owners otherwise has qualifications be effective in america.

- Just be old enough in order to signal a home loan lower than California credit rules.

- You should be to get a one-to-four-unit possessions for first home objectives.

What Else Normally FHA Financing Defense?

While you are finding repaired-uppers, and that suggest you are to buy a house that needs renovations, you need new 203(k) FHA financing choice. This can roll their restoration and financial pricing for the one financing. In the event the are curious about renovating or and then make transform with the latest home, the loan equilibrium shall be refinanced and also the cost of new change or home improvements added to the borrowed funds.

For those who need certainly to live green, discover an enthusiastic FHA Energy-efficient Mortgage. That it financial enables you to are the expenditures you happen so you’re able to the mortgage. not, this is exactly if they try related to high efficiency provides. If you find yourself 62 years of age as well as, and you can individual your house downright, or the loan balance is reasonable, you are able to have fun with Opposite Financial by the FHA to show your own collateral towards the dollars.

Looking A keen FHA-approved Bank

Remember that not all loan providers is acknowledged. Together with, those people who are approved have their particular criteria which are additional into FHA criteria. For it, and so many more causes, you have to do pursuit first the borrowed funds software processes. Very loan providers will help you when you’re applying. They will take you owing to one step-by-step publication into application processes. They together with help you through the method.

Are you experiencing a reduced credit history otherwise a low down payment to own a home when you look at the California? Ca FHA loan makes it possible to make your dream about managing property become a reality. E mail us now, our company is right here to help you loans in Ball Pond, or e mail us from the net.