Buyout Versus. Refinancing

Good buyout transmits the loan to a new financial, have a tendency to causing finest payment terms and conditions minimizing rates of interest 2 . During the an effective buyout, new financial pays your current label financing and you may requires arms of vehicle’s title while the collateral till the the fresh mortgage try totally reduced step 1 .

Refinancing, at the same time, renegotiates brand new regards to your current financing as opposed to mobile they to a different bank. This step can also end up in best mortgage words, nevertheless pertains to handling your existing financial to modify the loan’s requirements. Both choices features their advantages, however, a beneficial buyout tends to be more beneficial having individuals looking for all the way down interest levels and enhanced standards.

Comparing the money you owe and contrasting words and you can fees is crucial whenever choosing between a buyout and refinancing. Understanding the differences helps you make an informed choice one best suits your needs and you will financial requires.

- Straight down rates of interest compared to your current loan 2 . This leads to even more in check monthly payments, decreasing the financial stress on the highest-attention auto term financing cuatro .

- Improved customer care of the using a receptive lender. If you are dealing with a loan provider who is tough to communicate that have or uncooperative, an effective buyout provide a brand new start with a very supportive bank step one .

- To avoid repossession of these at risk of defaulting step one . Transferring the loan to another financial having best terms and conditions can also be conserve your car or truck. This is going to make an excellent buyout an invaluable option for borrowers unable to maintain the current title mortgage repayments.

Name Mortgage Examples

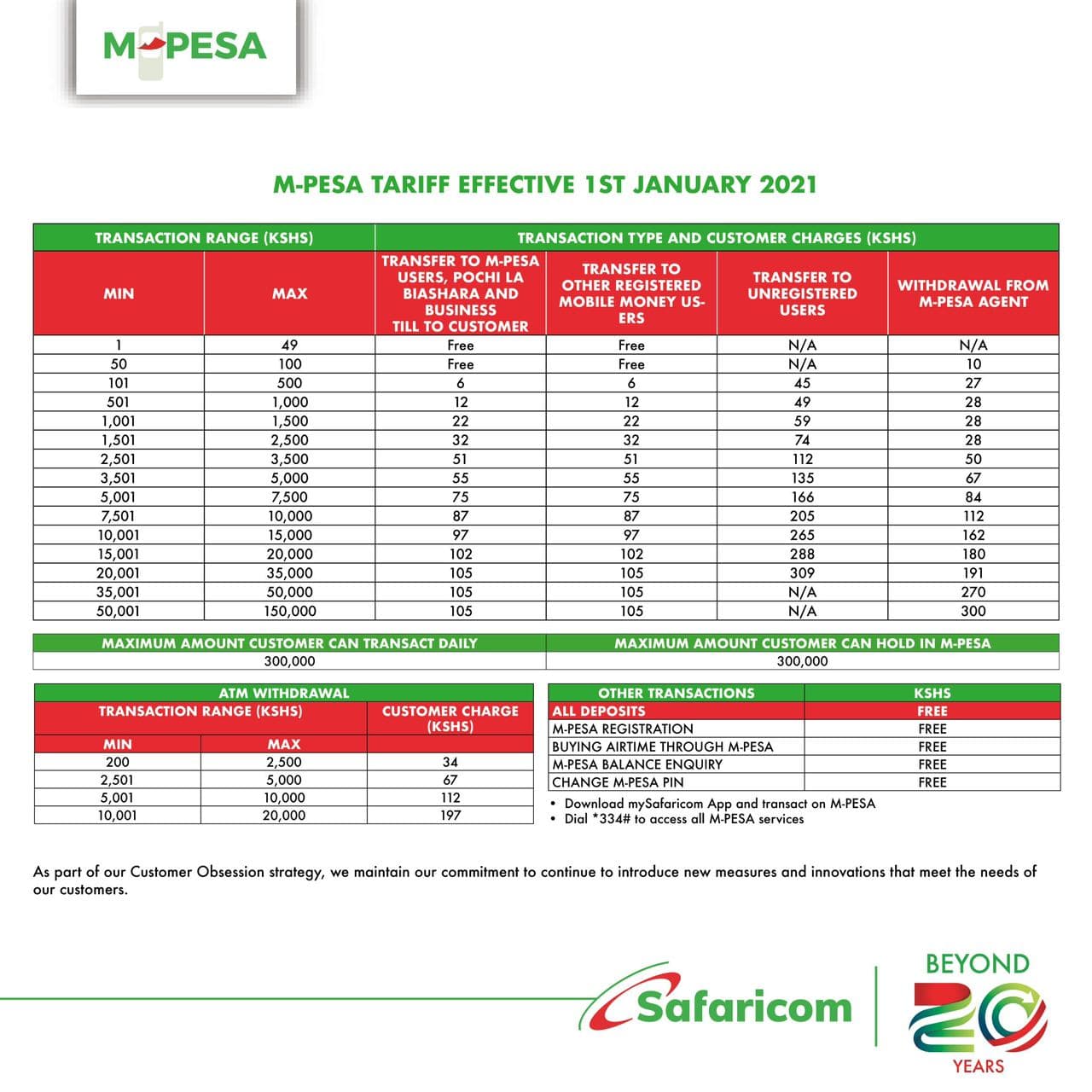

Listed here are a few examples you to illustrate the personal loans Montana differences within the identity loan words and how capable impact your own monthly premiums and you may complete costs:

This type of examples show exactly how some other interest levels and you can charge can affect the payment amount, reflecting the necessity of contrasting financing terms and conditions just before committing.

Exactly what Data files Should i Refinance My Identity Mortgage?

- The fresh car’s name

- Evidence of money

- Identification

- A credit check (may be needed) 1

When you yourself have missing your car or truck name, you could obtain a replacement through your local Service off System Vehicles (DMV). Which have your entire papers managed is extremely important so you can improve this new refinancing techniques.

Financial Tip

Refinancing your vehicle name mortgage may enables you to use a lot more fund, with regards to the conditions set of the the fresh financial. Yet not, look for any extra fees regarding the the new financing, and you may remark these types of meticulously.

Identity Financing Repossession

Incapacity to repay a motor vehicle name loan can lead to auto repossession, in which lenders can take and sell the car to recover the new financial obligation step one . Sadly, in lot of says, they’re not necessary to go back one excessive regarding profit in order to you, and that means you you certainly will get rid of your car nevertheless are obligated to pay money.

Depending on the Individual Economic Coverage Agency, a large number out of vehicle identity mortgage borrowers not be able to pay off their fund, ultimately causing high repossession cost. So it underscores the significance of carefully as a result of the small print of an automobile label financing and investigating all the available options to have installment or refinancing.

Discuss Your own Term Financing Refinance Choices Now!

Refinancing an automible label mortgage can also be safer ideal terms and conditions and you may overcome financial be concerned. Replacement your existing loan with a new you can produce a diminished interest rate and you will much time-name savings 1 . It can also bring additional time to repay the mortgage, good for those up against financial difficulties.

Refinancing can also enable it to be usage of more finance, according to their car’s security and you will income. The process generally speaking needs submission comparable documentation because new loan recognition app, and additionally an alternate automobile term financing contract.