Perform FHA mortgage legislation allow an FHA debtor rating the second FHA mortgage? That is a question that is necessary for certain-especially those exactly who ily size, or comparable items.

FHA mortgage legislation to the solitary-friends financing program claim that FHA mortgage loans are for holder-occupiers, but based on issues, a debtor may be passed by a performing bank to purchase another home–usually responding in order to a practical you prefer such a larger family members otherwise job requirements outside a good travelling point.

You will find a paragraph on FHA loan rulebook, HUD 4000.one, called FHA Requirement for Holder Occupancy that has the following:

FHA does not guarantee several Property since the a principal Residence for the Debtor, except as the listed below. FHA cannot insure a home loan when it is figured your order was designed to use FHA home loan insurance coverage since an effective auto for getting Financing Functions, even if the Possessions becoming covered could be the simply one had playing with FHA home loan insurance rates. Do you know the exclusions to the unmarried property rule?

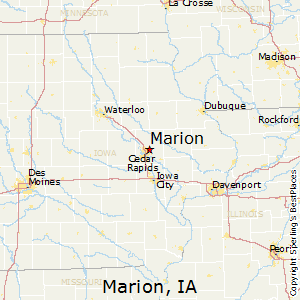

Based on HUD 4000.one, A borrower is permitted get another type of FHA-insured Home loan without being needed to promote an existing Property safeguarded of the an enthusiastic FHA-insured Mortgage when your Borrower is. relocating otherwise has moved getting a jobs-associated cause; and you can installing or has generated another Dominant Household inside the an enthusiastic area more than 100 miles on the Borrower’s most recent Dominant House. If your Debtor moves back on the new urban area, the brand new Debtor is not needed to reside the initial house and will receive a new FHA-insured Financial to the another Dominating House, given the brand new relocation match the two standards a lot more than.

An exception ily proportions, or a borrower that is vacating a collectively had possessions. In all things you to definitely qualify, the application to your the newest FHA loan was canned into the an excellent case-by-instance basis, so a borrower will need to manage his or her performing FHA financial to see what’s you can. There’s nothing completely wrong with powering your position previous that loan officer observe exactly what one standard bank could be willing to do.

HUD 4000.one will teach participating lenders, A borrower may be eligible for another FHA-insured Financial in the event your Debtor was vacating (and no intention to go back) the principal Quarters that will will still be occupied of the a preexisting co-Borrower.

FHA Mortgage Laws to have 2nd House Commands

FHA mortgage laws permit a low-occupying co-debtor to try to get an FHA mortgage off their/his or her own for as long as the fresh new financing is intended to buy an initial house.

Associated Financial Stuff

While refinancing within the basic 5 years may possibly not be essentially demanded, discover scenarios in which it may seem sensible. For example, in the event that large home improvements enjoys notably increased your residence worthy of, you might have adequate equity in order to justify an excellent refinance.

The new debtor who may have a dad purchasing education loan personal debt every times might possibly let you know the cash income out of you to definitely percentage is secure and you will credible. Loans placed in their unique label is also and most likely could be utilized in loans-to-income proportion data.

The new FHA Improve Re-finance are a program making it much easier if you have present FHA loans to re-finance. It had been designed to getting convenient and you can shorter than a normal re-finance, which have reduced documents and you may shorter acceptance moments.

FHA funds typically have occupancy criteria, definition you must decide to live in the house since your primary residence. For the typical cases, you could potentially commercially just have an FHA financing for one number one quarters immediately.

The procedure starts whenever a Crisman loans possible buyer discovers property and you can makes an offer to your vendor. In case your provide is suitable, the consumer work having a keen FHA-acknowledged lender in order to begin the loan application techniques.