Content

Unless you document your come back by deadline (in addition to extensions), you may need to pay failing-to-document penalty. The newest punishment is founded on the fresh tax maybe not paid off because of the deadline (as opposed to reference to extensions). The new punishment is often 5% for every month or part of 1 month you to a profit is actually later, yet not more 25%. Unless you document their get back and you will spend your own tax by the due date, you may need to spend a punishment. You may also have to pay a punishment for those who considerably understate their taxation, document a great frivolous income tax submitting, or don’t also have the TIN. For many who provide fake information on your own go back, you might have to pay a civil scam penalty.

Property

While you are searching for zero-rates or lowest-rates healthcare exposure advice, see the « Yes » field to the Mode 540, Side 5. High-Street Cannabis Income tax Borrowing – For nonexempt many years beginning to the or after January step 1, 2023, and you may prior to realmoney-casino.ca proceed this site January 1, 2028, the newest Highest-Road Marijuana Income tax Borrowing from the bank (HRCTC) will be accessible to registered commercial cannabis businesses that meet the qualifications. The financing are permitted to a qualified taxpayer inside the an amount equal to twenty five% of qualified expenditures in the taxable season. All types of entities, with the exception of excused teams, meet the criteria to allege that it borrowing. If you do not be considered since the an innocent spouse and for separation away from accountability, you can even qualify for equitable relief if you’re able to demonstrate that, considering all the facts and issues, don’t end up being stored liable for any understatement otherwise underpayment out of taxation.

These types of services are extremely minimal and generally is simply on-campus works, standard knowledge, and you can financial adversity a career. The consumer need statement and you can shell out along side withheld tax inside 20 weeks following transfer playing with Setting 8288. This type is submitted to the Internal revenue service having copies A great and you may B of Form 8288-An excellent. Content B of this declaration would be stamped acquired by the Irs and you may gone back to your (the seller) if your declaration is finished and has your own TIN. You need to file Content B with your tax return to get borrowing from the bank on the tax withheld.

Withholding to the Scholarships and you will Fellowship Has

Is to a resident need to problem the process, landlords will likely first invite a conversation for the renter in order to come to a contract. If it goes wrong, tenants could take the circumstances to small-claims judge, in line with the county in which they alive. Roost connects that have Yardi, Entrata, and you may RealPage so you can streamline put costs, refunds, and recuperation.

Should your deceased is actually married during the time of demise, another go back to your surviving mate have to be submitted that have the new filing reputation \ »single\ » unless he/she remarried s before the end of your taxable 12 months. Concurrently, a joint go back could be filed for the 12 months from demise in the event the one another taxpayer and you may mate is actually deceased and you may each other fiduciaries consent to help you file a shared go back. Enrollment that have Zelle as a result of Wells Fargo On the web or Wells Fargo Online business becomes necessary. To transmit or receive money which have Zelle, each party have to have an eligible checking or family savings. For the shelter, Zelle would be to only be used in delivering currency in order to loved ones, loved ones, or other people your trust.

While you are partnered/RDP and you will file a mutual get back, you must profile the amount of a lot of SDI (or VPDI) separately per mate/RDP. There is no need making estimated tax repayments for those who are a nonresident or the newest resident of Ca within the 2024 and you can didn’t have a ca taxation accountability within the 2023. To help you allege that it borrowing, your own federal AGI must be $one hundred,100000 otherwise shorter therefore must complete and you may mount form FTB 3506, Son and you will Centered Worry Costs Credit. For individuals who gotten buildup distributions of international trusts otherwise from particular home-based trusts, rating function FTB 5870A, Taxation to the Buildup Distribution out of Trusts, to work the additional tax. To quit you’ll be able to waits in the processing your tax return or reimburse, go into the proper tax amount about line. To help you immediately figure your own taxation or even be sure your own tax formula, have fun with our very own on the web taxation calculator.

- Long lasting situation, chat to their property owner about this prior to they capture judge action.

- Wells Fargo talks about of numerous what to influence your own credit alternatives; for this reason, a particular FICO Get otherwise Wells Fargo credit rating will not be sure a certain loan rate, acceptance away from a loan, or an improve on the a credit card.

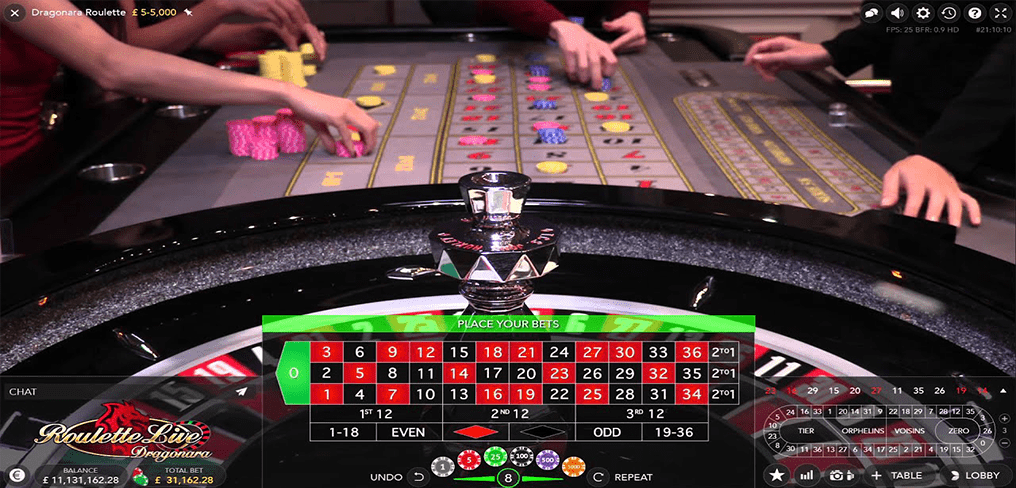

- All of our very in depth gambling enterprise ratings and you will proprietary score system are built to make it simple to choose and that choice out of some extremely rated local casino sites have a tendency to fit the better.

The end of the organization date is called the brand new « put cutoff time ». If you make a deposit ahead of our very own cutoff time to the an excellent business day that individuals is actually open, we are going to consider you to definitely day becoming your day of your put. Yet not, if one makes a deposit just after our very own cutoff day otherwise for the day we are not discover, we are going to think about the put getting produced to your second working day we is unlock. Pay bills, transfer and you may get paid along with your U.S. savings account and you may navigation count because of on line banking.

Lengthened delays will get pertain

Manage the name because of the composing precisely the past four digits away from your Societal Security count for the one view otherwise currency buy you post to the Income tax Department. You need to are your complete Personal Protection number in your go back and you will commission discount. With an excellent $25 lowest beginning deposit, you’ll appreciate professionals that are included with electronic cost management equipment and. You are analyzed both a later part of the filing and you can underpayment penalty for those who document the go back following due date (or prolonged due date) plus don’t shell out your tax liability together with your return.

- A person who makes the return and won’t ask you for should not fill out the newest paid off preparer’s area.

- For brand new circulate-in, professionals have to apply, be considered, and be accepted for the tool without having to use it assistance.

- Applicants must submit a rental ledger outlining its previous due balance.

- It is important to note that certain money points and you can range records applied to Mode It-201 otherwise Form They‑203 do not keep in touch with those found to your federal Setting 1040NR.

- This really is a great nonrefundable income tax borrowing from the bank from $500 for every being qualified individual.

Self-A career Income tax

You must mount a completely done Function 8840 to the money taxation return to allege you may have a closer link with a foreign country otherwise countries. You will want to very first determine whether, for tax motives, you’re a great nonresident alien or a citizen alien. Crisis tax recovery is available for these impacted by certain Presidentially stated calamities (discover Irs.gov/DisasterTaxRelief). Aliens that are necessary to document a You.S. taxation get back can be affected. To find out more, see the Guidelines to own Mode 1040, and/or Recommendations to possess Function 1040-NR. While we can be’t function myself to each remark acquired, i perform delight in the views and can consider carefully your statements and advice even as we inform the income tax models, guidelines, and you may books.

Most renters are incredibly excited to maneuver to your an alternative place or stressed because of the swinging process that it forget when planning on taking the amount of time to accomplish what they want to do to help them obtain deposit right back later on. Before you can flow their belongings into your the brand new set, get a number of important moments to carefully remark the new flat before you can relocate. Service of Homes and you can Metropolitan Development’s (HUD) Book Reasonableness Advice, ERAP might provide around 5 times the new local rental count founded on the city postcode and you can bedroom size of the new flat/home. Deposit dollars or and make a credit card deposit from the lobby kiosk is among the newer alternatives for to make a deposit. You can find charge for it transaction you are notified so you can in the put. Already, $two hundred is considered the most cash which are deposited per exchange.

This is any demand for property located in the Joined Claims and/or U.S. Virgin Islands or one desire (other than as the a creditor) inside the a domestic company that is an excellent U.S. real property holding business. Transportation income (defined inside the section dos) is actually effortlessly connected for those who meet all of the following requirements. Two tests, described lower than Money Money, later, determine whether specific items of financing earnings (such attention, dividends, and you may royalties) try managed since the effectively associated with you to definitely company.

RentCafe Citizen Portal try an internet center one to contact all the resident requires – away from using rent and you will entry work purchases so you can joining renter very important and you can earning advantages – all the from their mobile phone, tablet or laptop computer. Sign up a huge number of companies international you to choose Yardi property management application and you will characteristics to optimize every aspect of the functions. Which have Zero Responsibility protection, you’re refunded to possess timely said not authorized credit purchases, susceptible to specific requirements.

Alabama Leasing Assistance Software

Before you leave the us, aliens need to basically obtain a certification of conformity. That it document, as well as often called the fresh sailing allow or departure enable, falls under the amount of money taxation form you should document before making. Might found a sailing or deviation enable after filing a Function 1040-C otherwise Setting 2063.