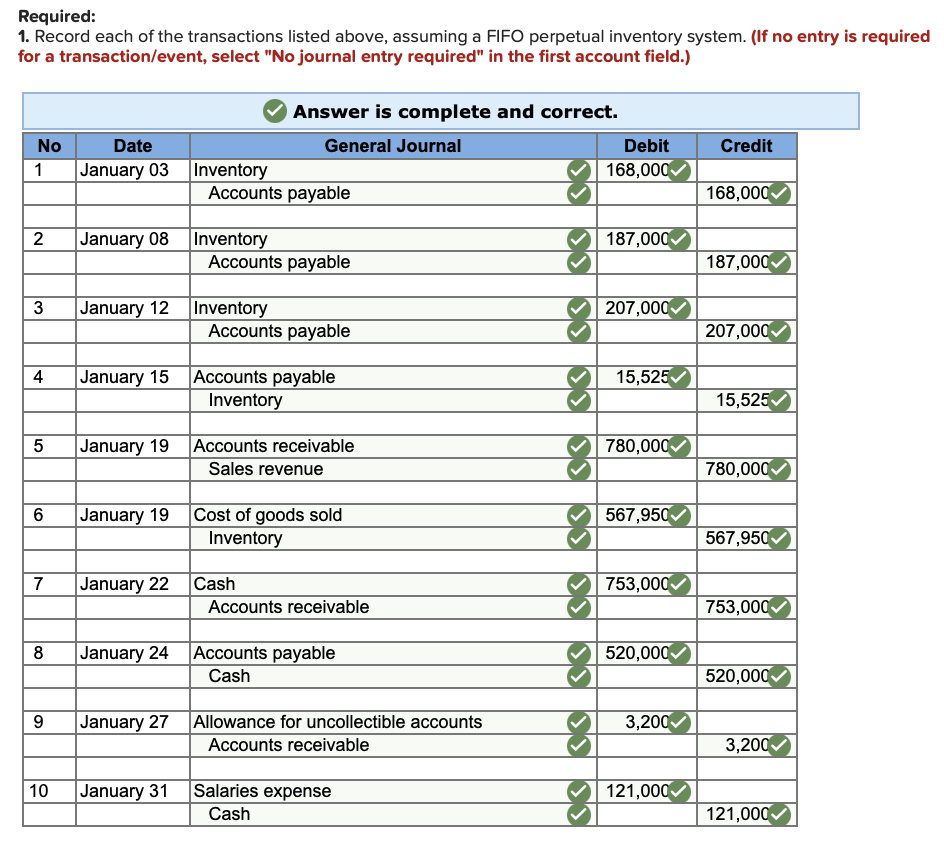

- They can’t afford the financing.

- They can’t supply the requisite limited income proof (select on this page).

- The protection property is beyond your lender’s guidelines.

- They don’t have an enormous sufficient put.

- They are already broke.

In these cases we possibly may advise you to make some change on the disease before we resort the job with one of our lenders.

Reduced doc does not always mean no financials

Lower doc money still require some sort of money proof while the necessary for the world Consumer credit Cover (NCCP) Operate.

- Company Hobby Statements (BAS): This proves this new return of your own team that’s indicative of your success.

- Accounting firms page: The all of our loan providers need a page out of your accountant you to verifies your earnings.

- Team membership statements: The newest cheque account comments for your needs can show your own turnover, and therefore means your success.

You will additionally signal a living declaration form that’s the report on lender telling all of them of your own team income. The amount of money you state need certainly to add up provided your age, advantage condition in addition to brand of functions your when you look at the.

Can you imagine you have zero earnings facts? Upcoming, first, question whenever you actually spend the money for financing! Whenever you then there is constantly some way to prove your income.

In case the financing is actually for providers purposes, your bank account are way too difficult or you was about along with your BAS upcoming a zero doctor financing can be compatible.

Just how will loans no credit check Minor AL they calculate my money?

Your income was analyzed since straight down of your own money that you declare on the money statement or the income analyzed from the financial.

Lenders normally have fun with forty% to sixty% of BAS or providers lender comments return to assess your money. It can differ with regards to the organization your in the. You can make use of our BAS Income Calculator observe how some of our loan providers really works.

Eg, a restaurant may have forty% of the BAS turnover assessed because income while a representative will get possess 80% of its BAS turnover provided. We are able to commonly dispute your own case towards borrowing from the bank department in the event that there’s a very good reason to use increased income payment.

Having an accounting firms letter yet not, the lending company only will use the income that the accountant proclaimed provided it suits money which you declared.

Are not any doctor loans readily available?

Yes, you can score a zero doc loan with a good poor credit records nevertheless interest rate can be relatively high. The loan must also feel unregulated by NCCP Act.

Applying

No, significant banking companies commonly looking reasonable doctor finance or people with a bad credit records. To your one or two combined they’ll merely assist you the door!

But not, our purpose is to find your loan refinanced having a primary financial in certain years time. Most people can prove the earnings contained in this a couple of years and if the their credit history has actually improved in addition to their payments was basically punctually upcoming we can usually rating a primary financial to help you leave you one minute possibility.

And that lenders might help?

These lenders don’t have branches and barely field themselves for the majority of folks. When they perform, it barely revision individuals of its rules or costs.

Pro lenders possess different loan possess into the major banking companies, specifically, they almost never offer design fund, counterbalance accounts otherwise credit line fund therefore it is way more difficult to find the kind of mortgage you to definitely best suits their needs.

It is hence that every those with a less than perfect credit records have fun with a large financial company to assist them to to select the correct financial and you will discuss the best rate of interest.