One benefit out-of homeownership ‘s the capability to faucet to your house’s value and turn it on cash. Which have a property security loan, home owners can be borrow secured on the collateral they’ve collected inside their assets and employ the bucks to possess things like home improvements, degree expenditures, debt consolidation, plus.

If you’re considering utilizing your family since the security to find money, you will need to be sure to know about some of the perks- in addition to dangers- of the property guarantee financing.

Professionals away from a house Collateral Mortgage

House security loans include particular renowned professionals. Listed below are some of the reason why individuals choose them more than other sorts of funds.

1. You should use money from a house security mortgage to have one goal.

Just what property collateral loan is utilized having is up to you. There are no lay assistance on what the bucks is also and you will cannot be allocated to. Generally speaking, however, somebody opt for family equity money on large expenditures, since creditors typically have the absolute minimum loan amount doing $twenty five,000.

- Renovations: You’ll your property use a number of enhancements otherwise remodels? Financing can give you the amount of money doing those individuals much-expected methods and home fixes.

- Medical expenses: Unanticipated scientific problems is also get-off individuals several thousand dollars in debt. A loan can help you shell out such of and get away from being taken to series.

- University expenditures: When you are wanting to go back to college or university to advance your studies or possess an infant planning to be removed to school, a property guarantee loan are a somewhat lowest-prices way to buy people expenses.

- Debt consolidating: Have you got other obligations on the cards and fund having high rates of interest? Repay such things as credit cards and private loans with your home’s guarantee. Combining the debt which have a lowered interest rate financing can help to save you eventually to make expenses your own costs quick.

- Begin a corporate: Of these seeking change a profitable side-hustle into an entire-big date gig, a home equity financing can supply you with the main city you desire to truly get your business up and running.

https://cashadvancecompass.com/installment-loans-il/windsor/

If you are you will discover foolish strategies for their finance, there is the versatility to make use of all of them because you excite.

2. Interest levels try repaired and frequently lower than most other funding options.

Since your loan try secured together with your domestic, loan providers can offer you straight down rates than just they’re able to with other styles out of financial support such as for example signature loans otherwise handmade cards. They also have a fixed interest, meaning you don’t have to care about skyrocketing costs over time.

3. A house equity loan is not difficult to qualify for features a lot fewer costs.

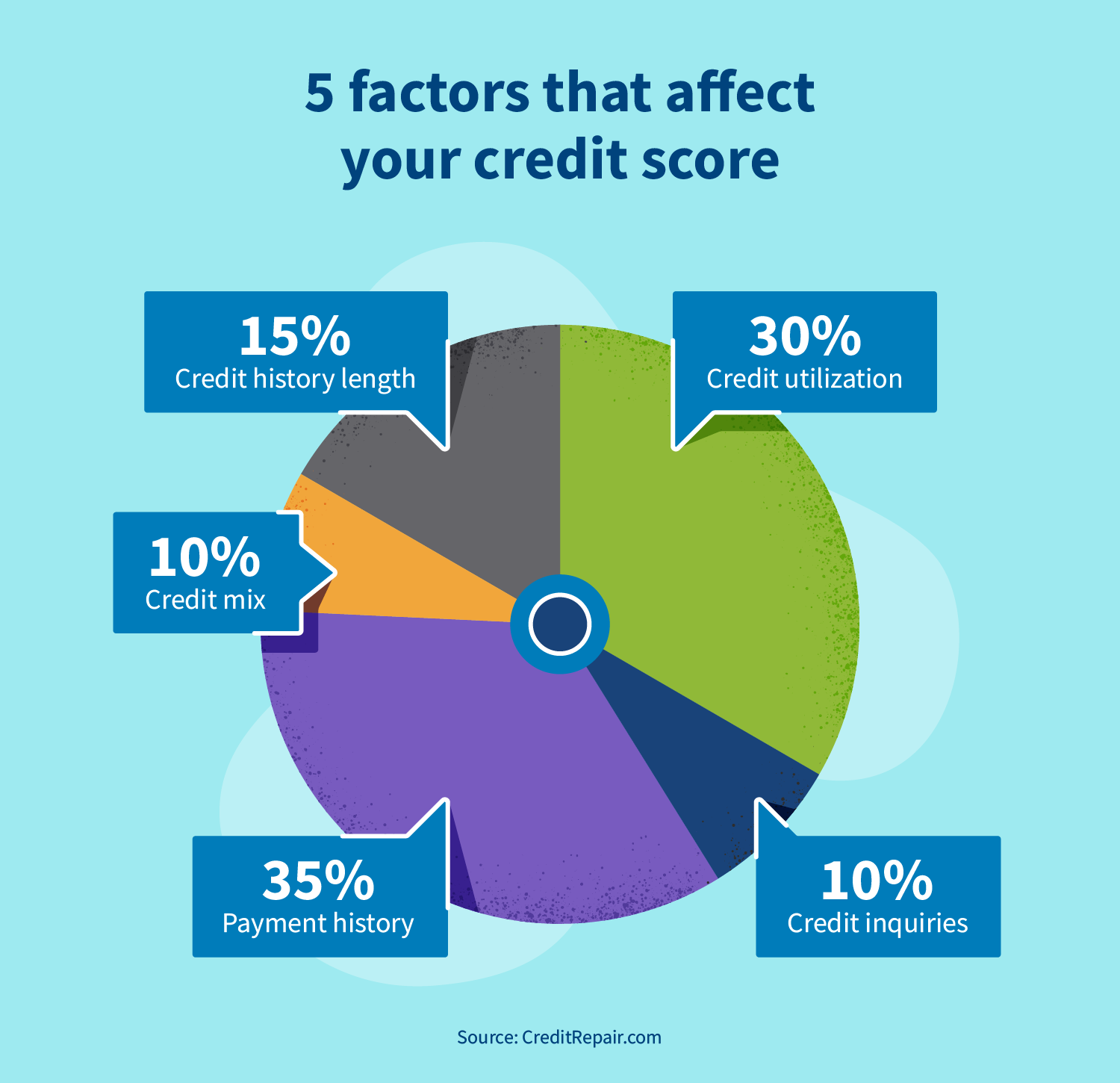

If you are you are going to need to fulfill specific criteria for example an effective credit get, a low personal debt-to-income ratio, and you can guarantee standards, property security mortgage is still relatively simple in order to qualify for because it’s shielded with your domestic.

Additionally, a property security loan is an excellent way to avoid pricey settlement costs. Specific loan providers only charge a decreased, flat rate within closure. Although not, it constantly helps to perform a little research, as certain financial institutions charge dos% to 5% of full mortgage amountparing financial rates and costs can help to save your many initial and over the class of mortgage.

4. You might take advantage of specific tax write-offs.

While by using the currency and then make improvements on the family that’s securing the mortgage, it is possible to be eligible for income tax positives. The newest Internal revenue service says that the notice repaid with the a home guarantee mortgage is actually income tax-deductible if it is always purchase, make, or dramatically increase on the house.

Keep in mind that you can only deduct notice doing $750,000 out of home-based fund as well as the developments must be designed to the house on which the mortgage are applied for. When you can easily make use of the guarantee of the home you live in making advancements to a rental assets, you can not subtract the attention.

Cons off property Security Mortgage

While you are there was so much as enthusiastic about, it is additionally vital to understand drawbacks so you’re able to an effective domestic guarantee mortgage.

step one. A home collateral mortgage uses your home given that security.

Utilizing your the place to find safer a loan mode straight down rates, but it also puts your house vulnerable to foreclosures. When you’re not able to make payments, the lending company provides a directly to seize your home and sell they to recuperate the losings. It is vital to make sure to makes your instalments, even in the event unanticipated expenses develop.

2. You’re taking to your much more personal debt.

Though it is generally less expensive than other sorts of credit, a home equity loan is still loans. Whenever you are still and work out the first mortgage payments in your family, make certain you feel the way to include a separate month-to-month commission towards the top of the totally new you to.

The greater financial obligation-to-income proportion that is included with taking up yet another mortgage can also be in addition to ban you from being qualified with other funds while you are attending generate an alternate highest purchase soon.

step three. In the event the markets injuries, you’ll find yourself under water.

Into the an unfortunate circumstances, you will probably find on your own under water having a property equity mortgage. By using aside a giant financing and the housing industry accidents or something reasons your house’s well worth to decrease instantly, you can indeed are obligated to pay more on your house than just it’s value. Which have an underwater financial otherwise mortgage can possibly prevent you from promoting your residence unless you have the money to spend the loss.

Is a house guarantee mortgage wise?

Like most mortgage unit, you can find advantages and disadvantages out-of a property equity financing. They offer independence within a low cost, being one or two characteristics which make all of them attractive to of numerous individuals. However, you should just remember that , you’ve got more your own borrowing from the bank on the line using this type of loan- youre including placing your house at stake. But, when you are confident you’ll pay off the bucks, property equity loan is the best economic services having your situation.